Third quarter 2025 and prospects

Ongoing pressures weigh on the EU textile industry in Q3 2025, but positive signals for the textile industry emerge, in terms of improved business confidence.

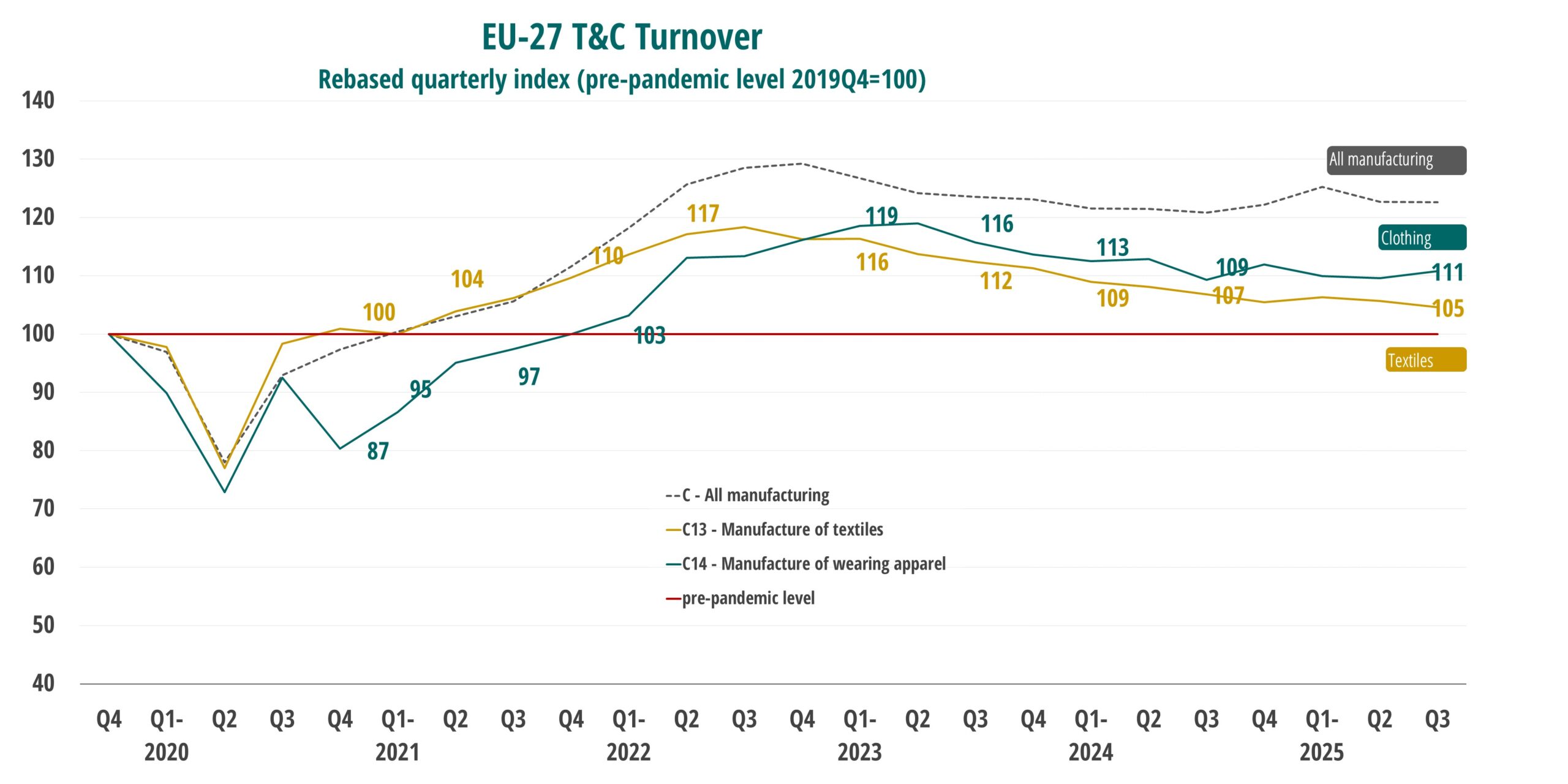

The EU textile and clothing (T&C) industry has experienced prolonged difficulties since 2024, as turnover contracted due to subdued demand, intensified competition from low-cost imports, and declining global shipments. Consequently, year-on-year sales in T&C continued to fall through mid-2025. Notwithstanding these trends, the third quarter registered signs of improvement in the clothing sector, reflected in a rise in turnover.

EU T&C production has continued to decline since mid-2022. Lack of demand remains the single most important factor limiting production and business activity, followed by labour shortages.

Employment in the sector remained under threat, due to restructuring, high costs, and skill shortages. Nevertheless, workforce trends in the EU clothing sector indicated a modest recovery in the third quarter of 2025.

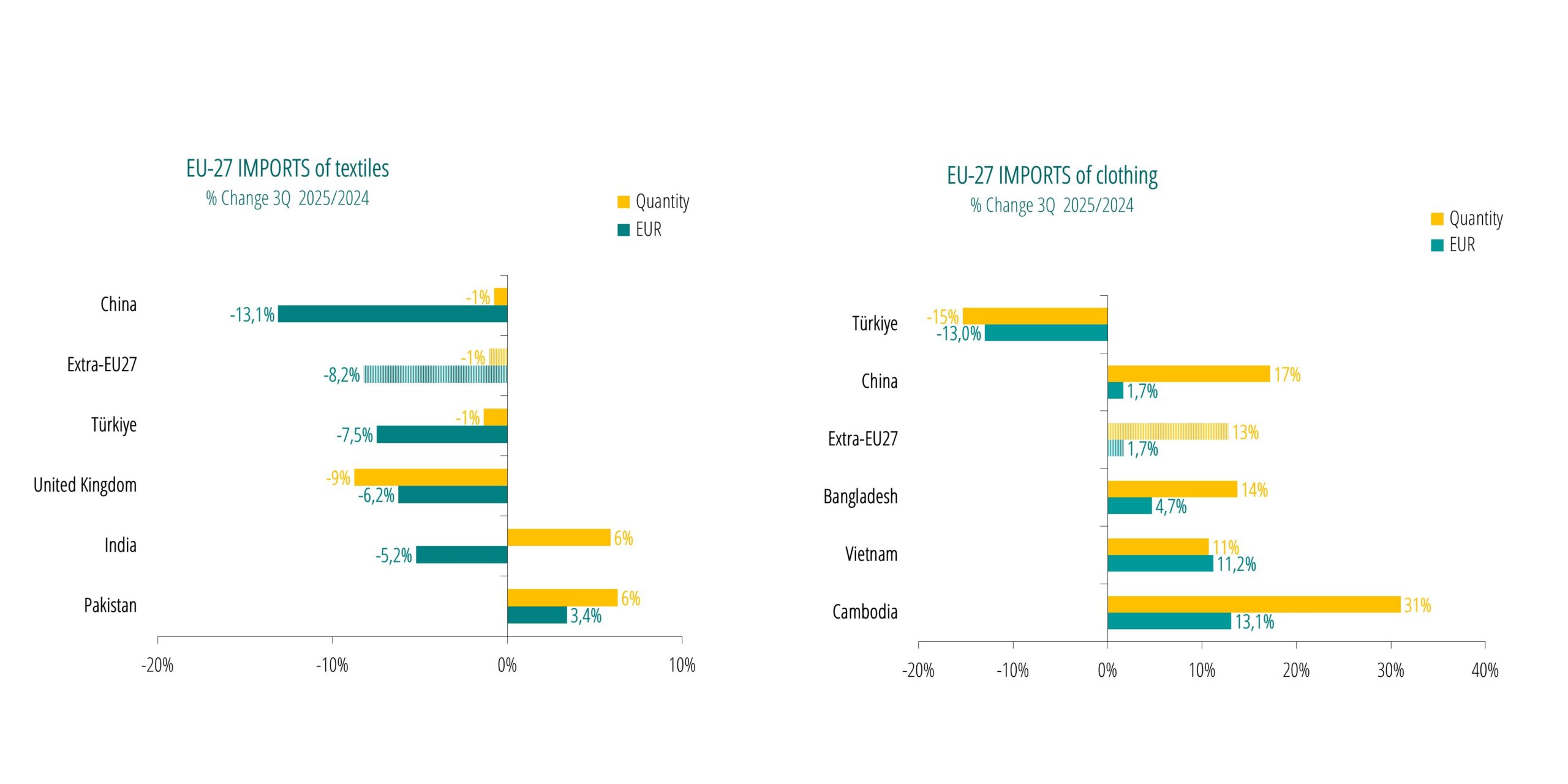

On the external side, trade flows between the EU and third countries weakened, leading to a year-on-year slight increase in the EU27 trade deficit. This shift was driven by rising imports of clothing articles from Asian countries, and decreasing exports in both textiles and clothing.

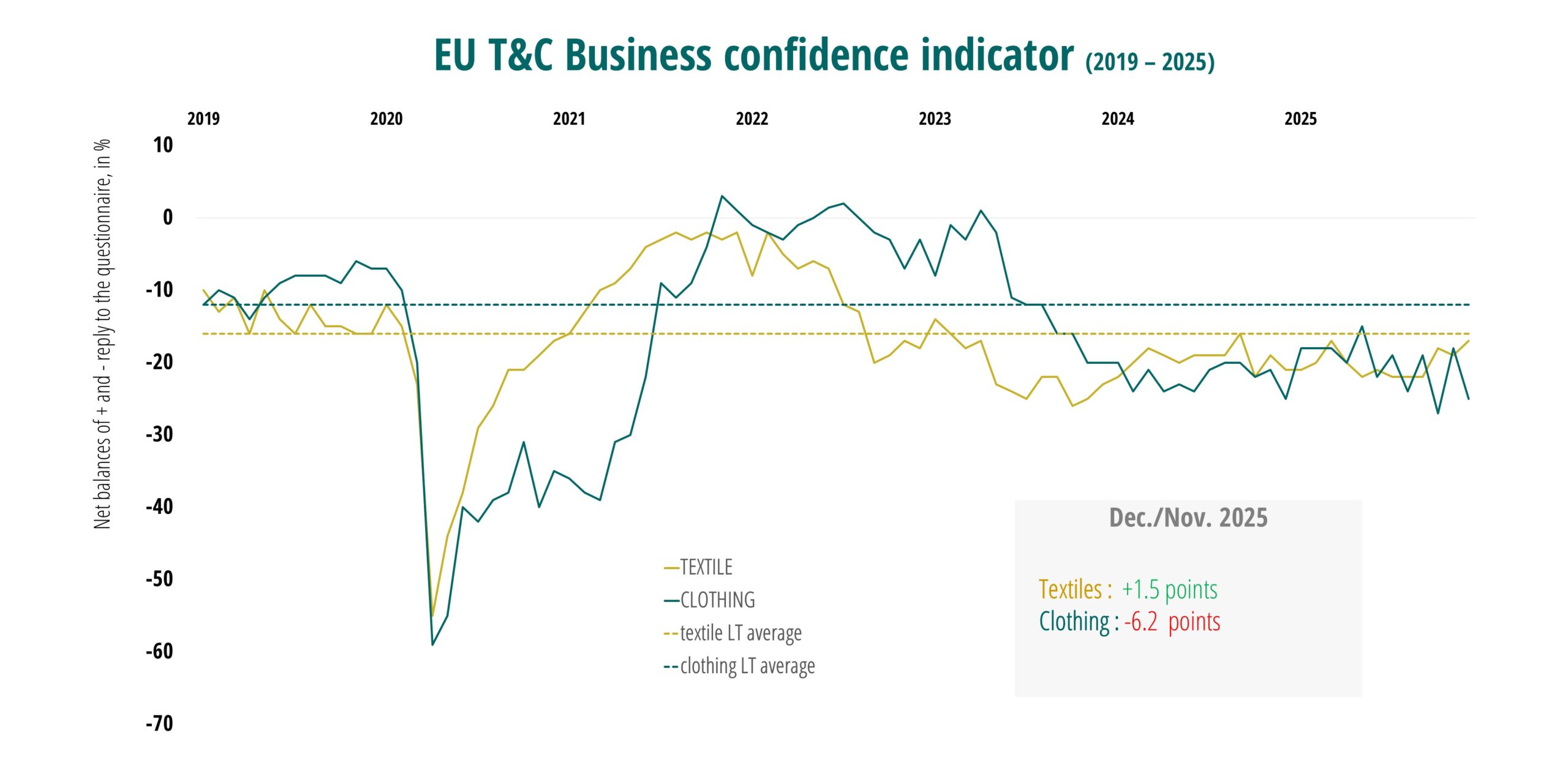

EU business confidence in December 2025 edged up in the textile industry, but showed a strong deterioration in the clothing sector. The positive trend in the textile industry was driven by managers’ brighter opinion on the current level of order books. Besides, employment expectations in textile saw a notable improvement.

For more information on our Economic Update, please contact Roberta Adinolfi.

Get your copy now!

Keep up to date with the latest facts and figures of the Textile and Clothing sector

by subscribing to the Economic Update!

Click here to fill in the subscription form or contact roberta.adinolfi@euratex.eu.