Fourth quarter 2024

and prospects for 2025

The rebound in the clothing sector brings some hope, even if the downstream segments still face difficulties. Small positive signals for the industry also emerge in terms of improving business confidence.

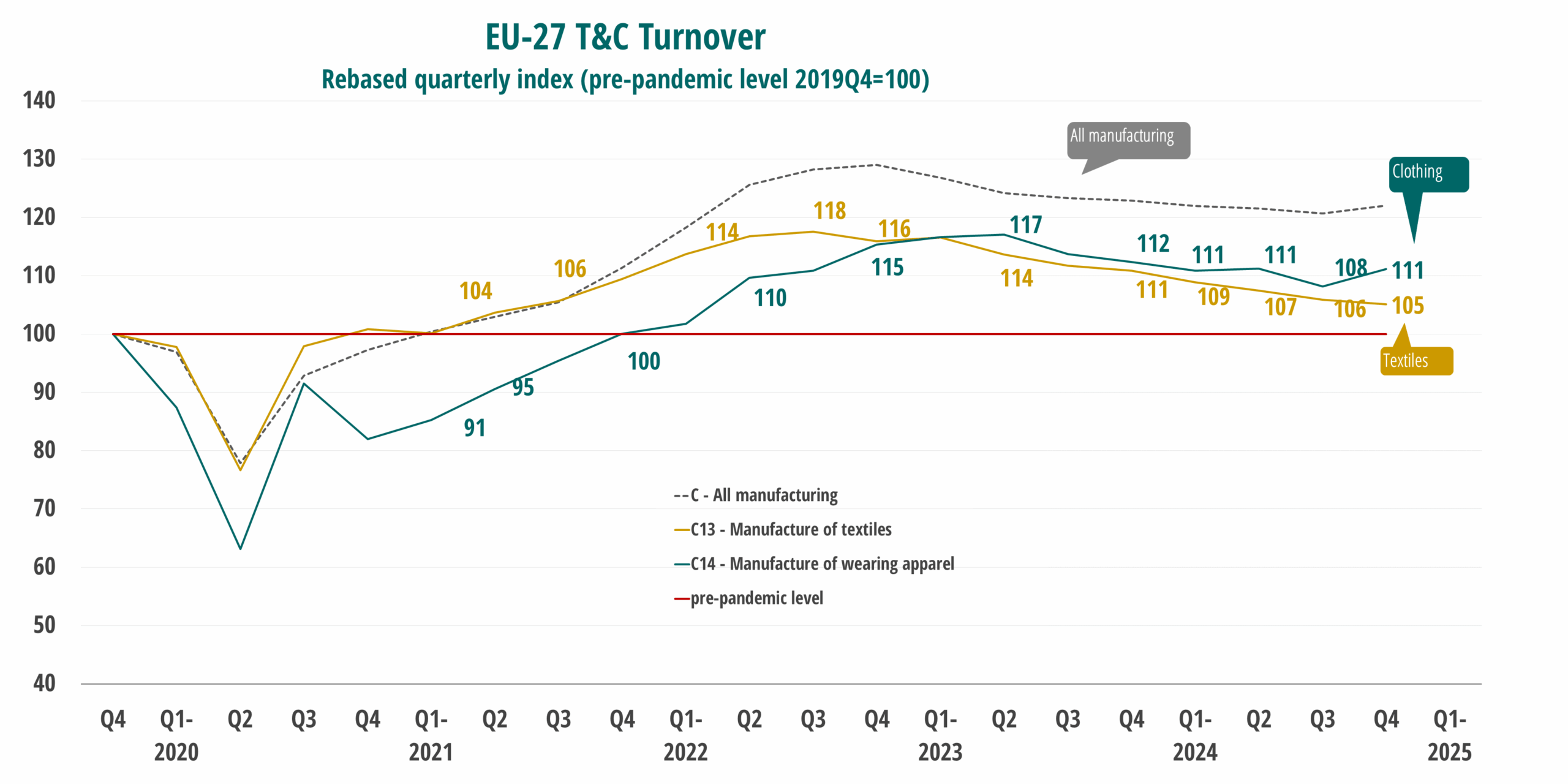

In the fourth quarter of 2024, the clothing sector experienced a significant rebound in production (+6.3% q-o-q) and sales (+2.7% q-o-q), while textile production was down for the eleventh consecutive quarter. The EU T&C industry faced consistent challenges since the beginning of the year, with continued poor demand in the EU. The decline in T&C production and turnover, observed over the full year, suggest external pressures such as supply chain issues, lack of demand, and high operational costs. High economic uncertainty is making consumers reticent to spend and companies hesitant to invest further. Persistently higher energy costs in Europe (compared to Asia and North America), bureaucratic hurdles, and the cost of compliance with new regulations are clearly among the key challenges for companies.

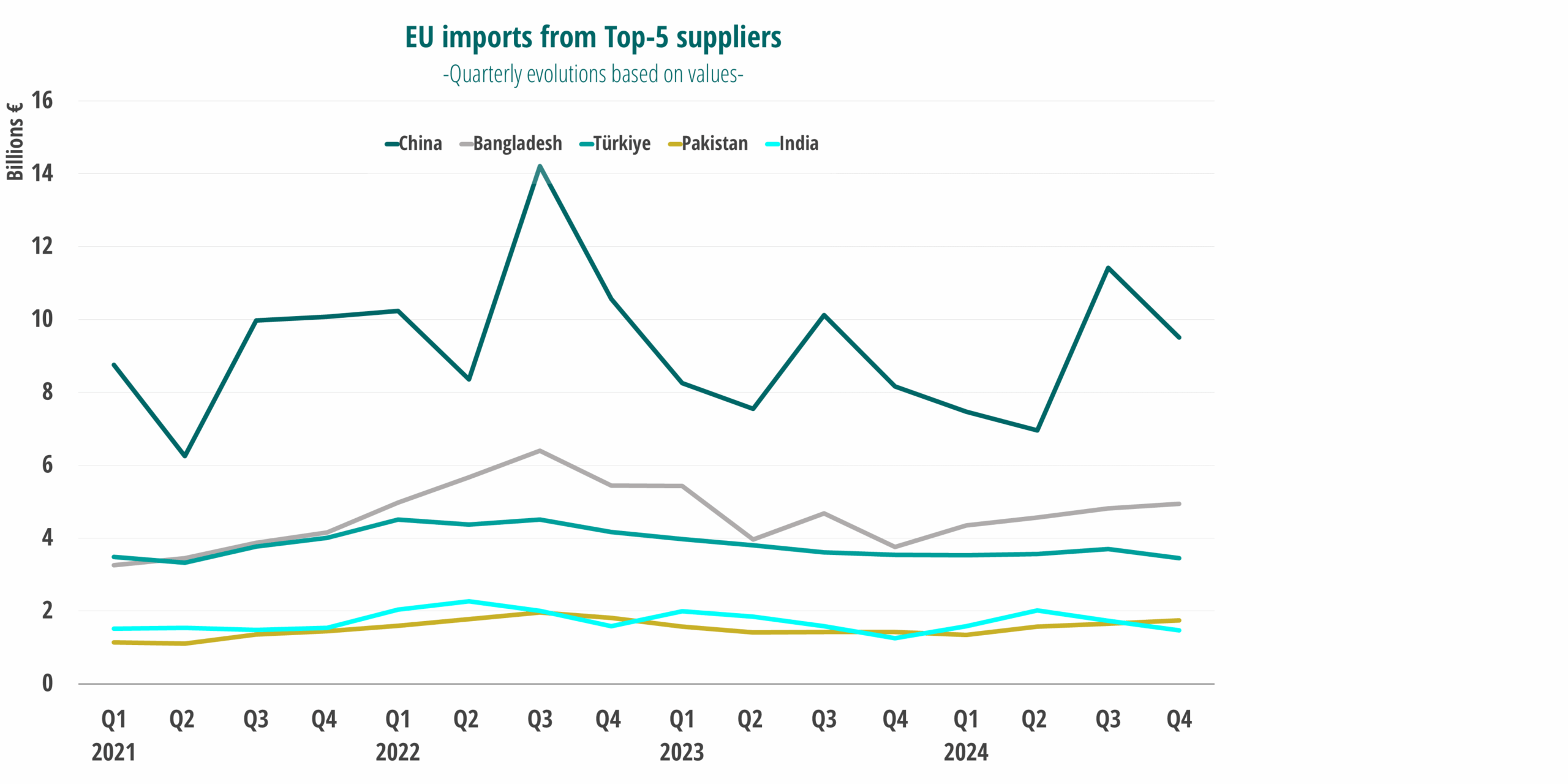

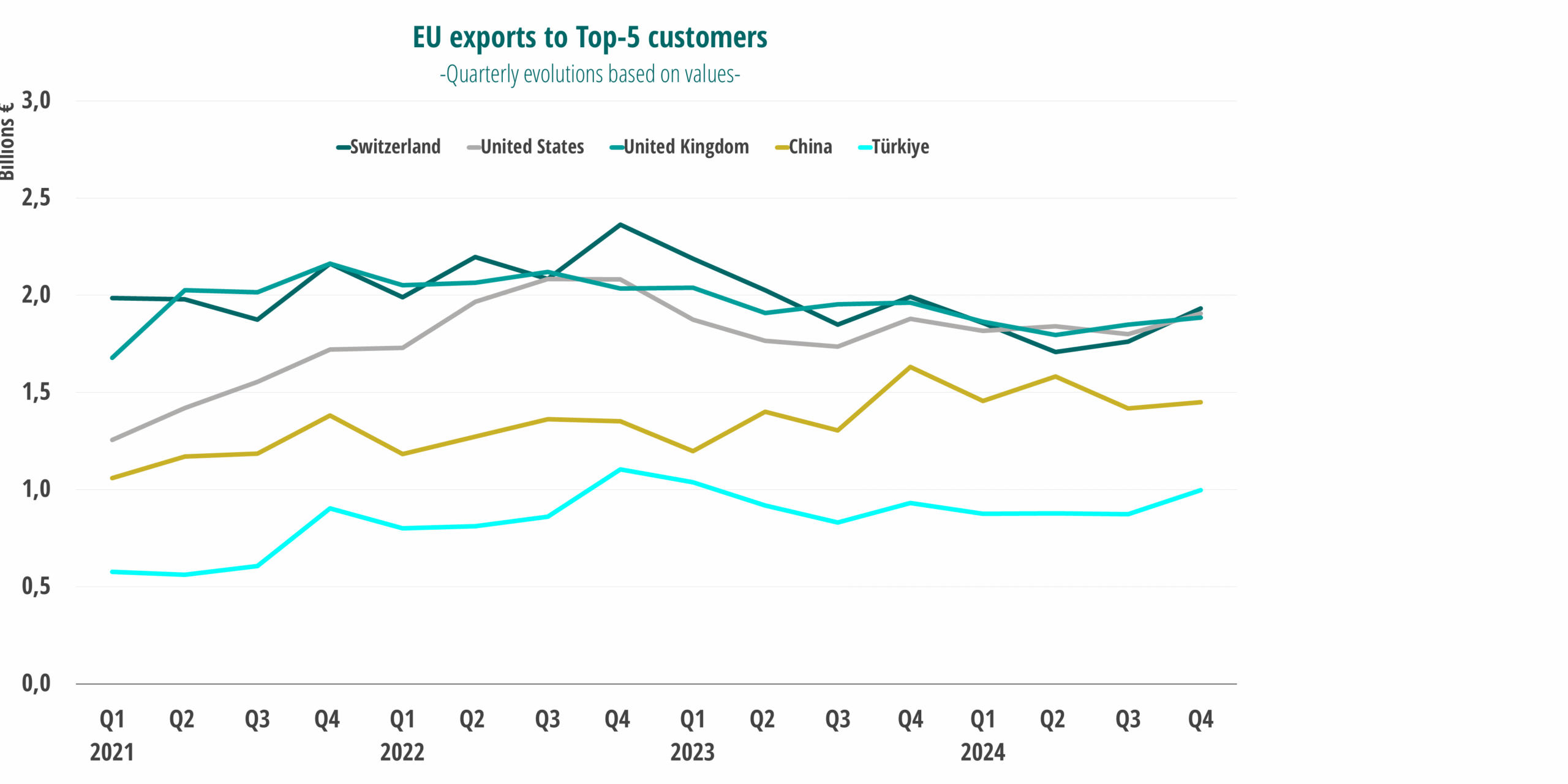

The economic uncertainty is gradually affecting the labour market. Employment levels in the textile and clothing sector deteriorated, as compared with the previous quarter and previous year, indicating difficulties to retain the workforce. In 2024, T&C firms have reduced their workforce or have paused recruitment efforts due to the highly uncertain outlook and the high labour costs. On the external side, the EU trade deficit decreased as compared with the previous quarter, as imports with third countries slowed down, whereas exports showed greater dynamism. Looking ahead, the overall trade outlook suggests challenges ahead, particularly upside risks from potential tariff implementation in the US and unfolding retaliation measures.

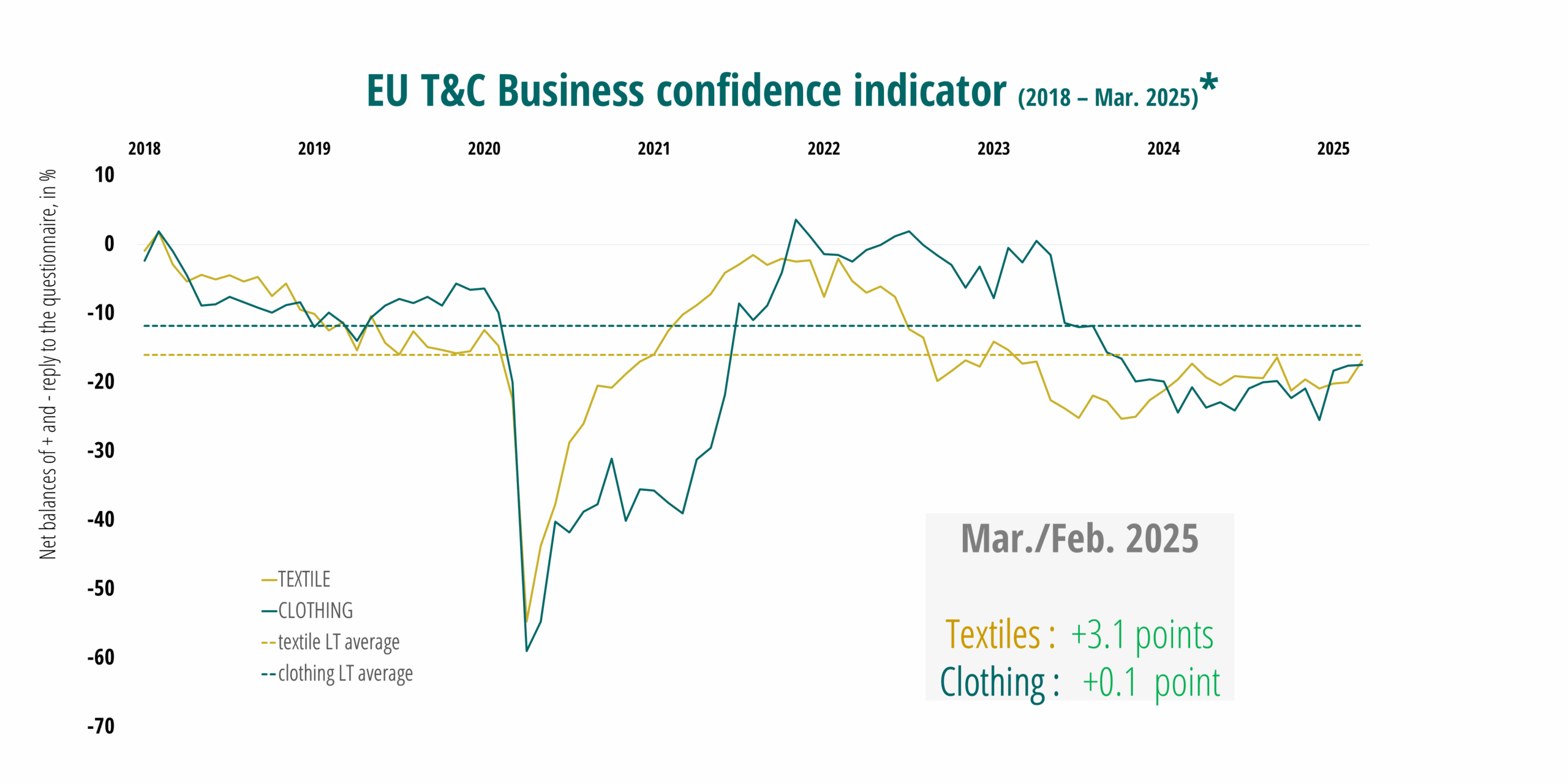

Despite these uncertainties, the EU business sentiment in March 2025 showed slight improvement in both textile and clothing segments. The positive trend was mainly driven by managers’ brighter opinion on the adequacy of stocks of finished products and improved production expectations in the textile industry. Furthermore, employment expectations largely improved in both industries. From the consumer perspective, confidence resumed its downward trend observed since late-2024. Similarly, retail trade confidence edged down, due to more pessimistic expectations about the past and future business situation, and the volume of stocks.

For more information on our Economic Update, please contact Roberta Adinolfi.

Get your copy now!

Keep up to date with the latest facts and figures of the Textile and Clothing sector

by subscribing to the Economic Update!

Click here to fill in the subscription form or contact roberta.adinolfi@euratex.eu.